Are leases hiding in your contracts? Identifying embedded leases

In 2019, the new FASB lease accounting standard, ASC 842, began to go into effect for public company filers. Other entities, including private companies, had an additional year to prepare for adoption.

ASC 842 closes the lease accounting off-balance sheet loophole which allowed corporations to report their operating leases, often a major portion of the lease portfolio, in the footnotes of financial statements. Under the new standard, companies are required to capitalize operating leases on the balance sheet — reporting them as right-of-use assets and lease liabilities.

When it comes to ASC 842 compliance, the challenges related to accounting for known leases may be grabbing headlines but identifying contracts that contain embedded leases adds another level of difficulty.

Not every lease says “lease” on the cover or is in legal form

An embedded lease is a lease agreement that exists within a contract. A lease is defined as a contract that conveys the right to control the identified asset for a period of time in exchange for consideration.

Identifying and collecting the contracts that may contain embedded leases can be like a scavenger hunt because all contracts that meet the accounting definition of a lease will likely not be labeled as such, and many organizations fail to recognize that service contracts often contain embedded leases.

Real-world example

IT services: A hospital subject to HIPAA regulations engages an IT service provider to provide cloud-computing services. To ensure that patient privacy rights are not violated, the contract requires a single dedicated server be used to provide the services. The hospital decides when and how the dedicated server is used based on its instructions to the IT service provider. The contract contains an embedded lease of the dedicated server.

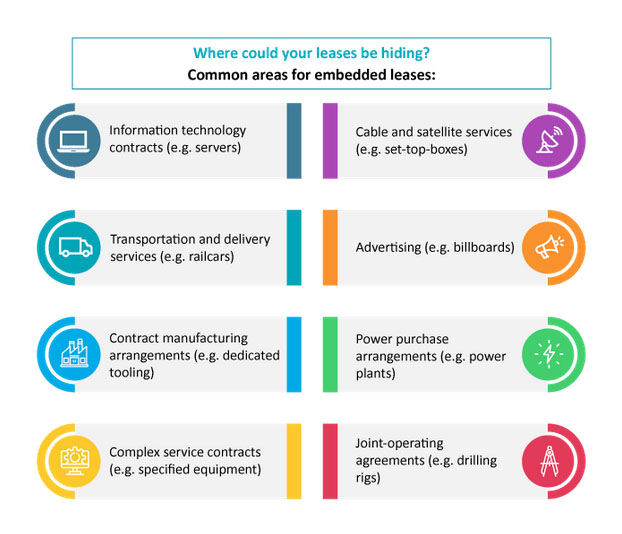

Where can you find embedded leases?

Reach out to your supply chain, procurement and/or requisition and IT departments, for an understanding of the inventory of their service contracts to determine if these agreements contain an embedded lease.

Logistics, transportation, warehousing, and data center service contracts are among the most common places to look for embedded leases. For banks, ATM service contracts could be another source of embedded leases. Since those contracts often don’t contain the word “lease,” you’ll need to look for language that says “exclusive use,” “solely,” “Identification Number,” etc.

Introducing Bumi for Embedded Lease Abstraction

At HighIQ we are creating the next-gen pre-built Contract Abstraction capabilities to handle complex use cases such as embedded leases, automatically and within minutes. This allows your accounting department to remain compliant with the growing needs of ASC 842.

HighIQ’s intelligent contract reader, Bumi, is powered by HighIQ’s proprietary algorithms, Amazon Web Services (AWS), and Amazon’s Textract, which automatically extracts data from scanned documents. Deploy intelligent automation for contract abstraction instantly in your own secure AWS Cloud environment.

Talk to us

Get started on your intelligent automation journey with our experts!